1. Understanding the shopping environment:

Payment requirements and preferences vary significantly depending on:

The sales channel: On-line, in-store or via a mobile, each environment has its own requirements.

Basket amount: Payment in instalments will be more appropriate for large basket amounts, while quick payments are better for smaller baskets.

Local habits: In some countries or geographical areas, certain local payment methods are essential and help to reassure customers.

Customer profile: A loyal customer may prefer one-click payments to save time, while a new customer will look for a reassuring option that is easy to understand.

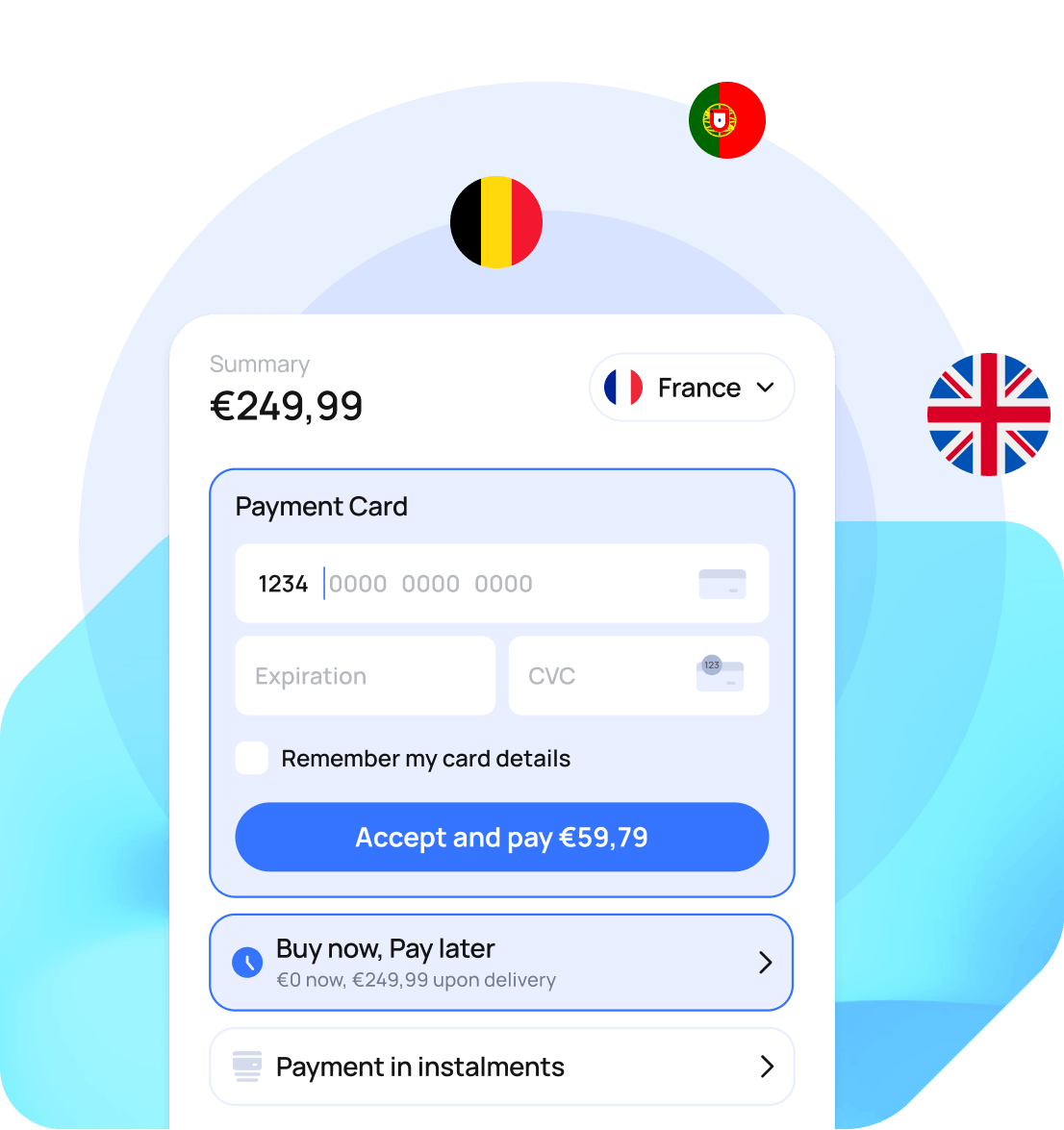

2. Personalising payments

Improving the customer experience

Providing an appropriate payment method simplifies the shopping pathway, reduces friction and reassures your customers.

For example:

Mobile payments using Apple Pay or Google Pay can be confirmed in an instant without any effort.

Payment links are ideal for remote sales.

Reducing the number of abandoned baskets

35% of abandoned baskets are due to customers not finding their preferred payment method.

Increasing your conversion rate and average basket size

Split or deferred payments or Buy Now Pay Later facilities encourage customers to finalise their purchases for large amounts or for impulse / unexpected purchases.

Building your customers’ loyalty

A fluid and adapted payment experience boosts customer satisfaction, thereby increasing the probability of customers returning for further purchases.

3. Adapting payment methods to the basket amount

Small amounts (less than €50):

Customers prefer quick options such as contactless payments, wallets or one-click payments.

Intermediate amounts (€50-200):

Offering recurring or card payments is still appropriate, but adding payment in instalments may attract certain consumers.

Large amounts (more than €200):

Split or deferred payment solutions are a key argument, enabling customers to spend large amounts.

4. The role of consumer habits in payment decisions

Cultural and geographical diversity

In France, card payments are the most common payment method, but payment in instalments (BNPL) is enjoying sharp growth.

In Germany, bank transfers and payments upon invoice are very popular.

In Asia, digital wallets such as WeChat Pay and Alipay are ubiquitous.

Digital trends

Consumers are increasingly keen on mobile solutions such as wallets, which are a quick and practical tool.

The purchasing channel influences expectations

In-store: Contactless and quick payments are the most common.

On-line: A wide range of secure options (card, wallet, BNPL) are essential.

On the move: Payment links and QR code payments simplify the check-out process.

Thanks to our Smart Display functionality, you can go even further and display only the most appropriate payment methods depending on the shopping environment and the customer, thereby reducing hesitations and optimising your conversion rate.