OMNICHANNEL

PAYMENT

With omnichannel payment, centralize all your transactions into a single system and offer your customers a smoother shopping experience.

AGILE system

Quickly integrate new channels and payment methods, and stay ahead of market trends. Monext offers a robust and scalable solution.

SEAMLESS EXPERIENCE

Offer your customers a unified and optimized shopping journey — no matter which channel they use.

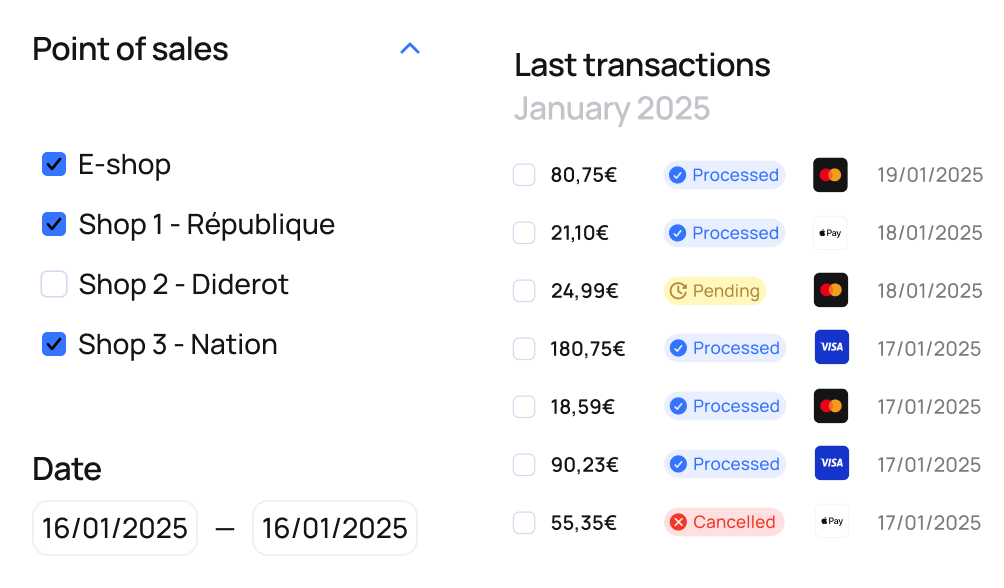

CENTRALIZED MANAGEMENT

Monitor your payments with a single dashboard and make strategic decisions with clear, data-driven insights.

An integrated approach,

enhanced commerce

FLEXIBILITY & SIMPLICITY

THAT ENHANCE CUSTOMER EXPERIENCE

Provide your customers with a wide range of payment options for online, in-store, or mobile purchases.

Monext ensures smooth transactions and helps you streamline operations.

CENTRALIZED DATA TO POWER YOUR BUSINESS

Gather all your data in one unified console. Understand your customers better with actionable insights to fine-tune your strategy.

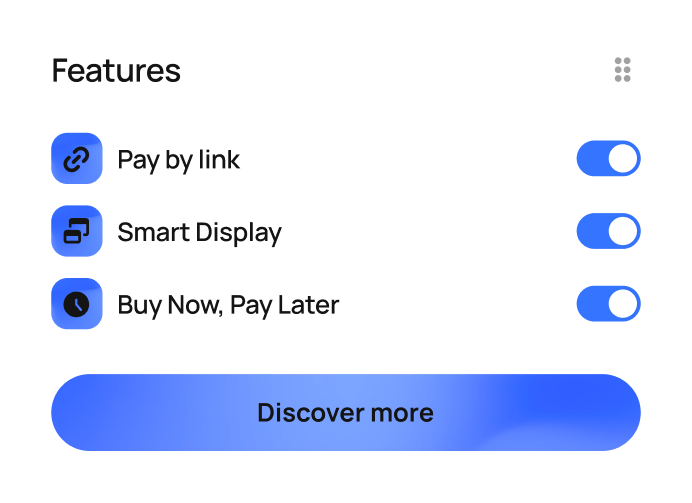

FLEXIBLE SOLUTIONS TO DRIVE GROWTH

Add new channels, integrate new features, and expand internationally — all with one flexible, future-ready solution.

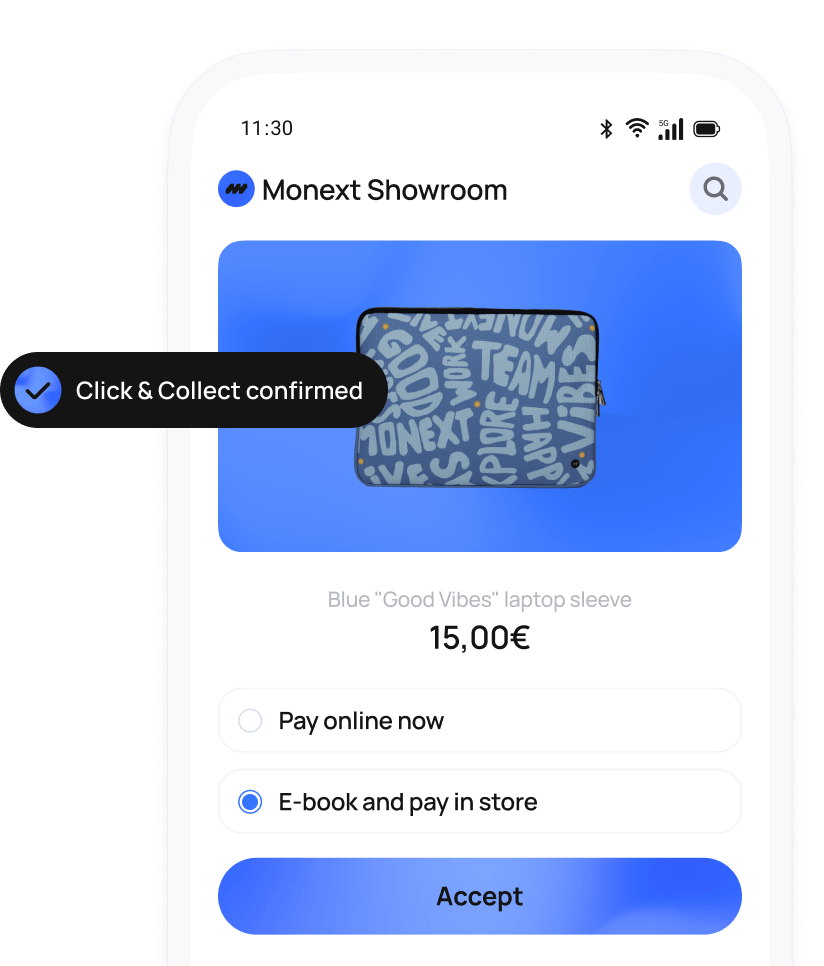

THE BEST OF E-COMMERCE MEETS THE BEST OF IN-STORE

- E-booking and online deposit payment

- Online authorization and in-store pickup

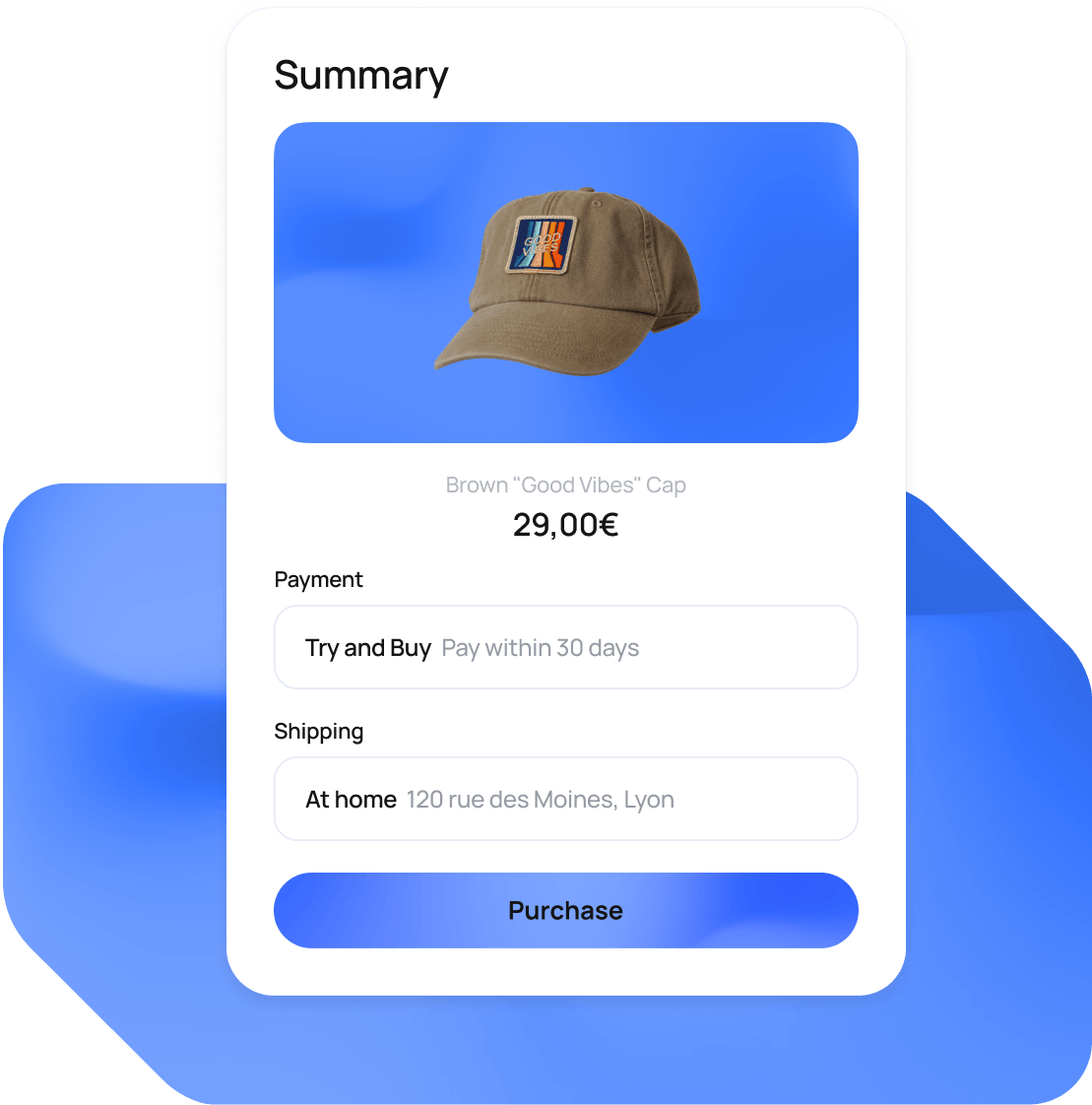

- Try & Buy option

- Trial-based transaction fees

- Access to in-store payment methods: Buy Now, Pay Later

- Pay by Link

FREQUENTLY ASKED QUESTIONS ABOUT UNIFIED COMMERCE

Unified commerce, multi-channel, cross-channel or omni-channel commerce: what is the difference?

The terms unified commerce, multi-channel, cross-channel and omni-channel are often used but refer to different approaches to the customer pathway and to payment management using different channels such as physical stores, e-commerce, click & collect and drive thrus.

📌 Here’s a comparison of the concepts:

- Multi-channel: Use of several sales channels (physical stores, e-commerce site, mobile applications) but these channels are unrelated. For example, a customer can purchase in-store or on-line but these two experiences are separate.

- Cross-channel: Integration of channels for seamless interactions. For example, a customer orders on-line and collects the item in-store (click & collect).

- Omni-channel: Real-time connection of all channels for a unified experience. For example, a customer starts the purchase on a mobile, continues on a computer and finalises it in-store in a seamless approach.

- Unified commerce: An advanced vision of the omni-channel approach, with centralised inventory, payment and customer data management on all channels. For example, a customer can see the stock available in-store and on-line in real time, with a single basket and synchronised payments.

💡 Important information:

👉 Multi-channel segments, cross-channel connects, omni-channel unifies and unified commerce centralises everything in a single solution.

What are omni-channel payments are why are they important for my company?

Omni-channel payments enable merchants to accept payments on several channels (on-line, in-store, via mobile, via payment links, etc.) while unifying payments in a single system.

Why is this important?

- It improves the customer experience with seamless payments.

- It centralises data for better management.

- It builds loyalty through a seamless and frictionless shopping experience.

How can on-line, in-store and mobile payments be unified with an omni-channel solution?

An omni-channel payment solution is based on an infrastructure that connects all payment channels to a single platform.

🔹 Here are the steps to unify your payments:

- Select an omni-channel solution that integrates e-commerce, in-store and mobile payments.

- Use a single gateway to centralise transactions.

- Synchronise payments with a CRM or ERP for smooth management.

- Offer flexible payments: cards, wallets, split payments, etc.

- Ensure optimum security.

What are the advantages of an omni-channel payment solution for the customer experience?

An omni-channel payment solution improves customer satisfaction and boosts sales through a seamless and consistent approach.

The main advantages are:

✔️ A frictionless shopping experience: a customer can start the purchase on-line and finalise it in-store, or vice versa!

✔️ Payment methods suited to each channel (cards, Apple Pay, Google Pay, etc.).

✔️ Customer relations: customer knowledge, loyalty programmes, simplified refunds.

✔️ Centralised customer data for improved customer knowledge and personalisation.

Which payment methods can I integrate into an omni-channel solution?

A good omni-channel payment solution must offer a wide range of payment methods in line with customer preferences to combine the best of e-commerce and physical stores.

💳 Conventional payment methods:

- Bank cards (CB, Visa, Mastercard, American Express)

- SEPA bank transfers and direct debits

📱 Digital & mobile payments:

- Apple Pay, Google Pay, Samsung Pay

- Payment via QR Code and NFC

- Payment links

🌍 Alternative & local payments:

- PayPal, Klarna, Alipay, WeChat Pay

- Payments in instalments (BNPL: Buy Now Pay Later)

NO CONTACTLESS HERE

Our teams are always here to listen and assist with any questions, collaborations, or commercial inquiries.