Omnichannel sales: a new reality you cannot ignore

Shopping habits no longer fit neatly into separate channels. One customer might discover a product on your website, compare it on their mobile, then visit a store to complete the purchase. Another might do the opposite, testing a product in store before ordering it online to benefit from a promotion or more convenient delivery.

What matters now is not the channel itself but the continuity of the experience. Customers expect the same information, simplicity and level of trust whether they are behind a screen or standing in front of a sales assistant. Studies confirm this shift in expectations and show that consistency across every touchpoint has become the norm rather than a differentiating factor.

For merchants, this changes everything. Omnichannel is no longer a nice to have strategy, it is a requirement to remain competitive. The brands that stand out are those that connect their stores, e-commerce sites and payment systems to create a seamless, coherent and uninterrupted journey. In this context, omnichannel sales become a powerful growth lever rather than a technical challenge.

Omnichannel, multichannel, unified commerce: understanding the differences

Terms like multichannel, cross channel, omnichannel and unified commerce are often used interchangeably, yet they describe different ways of managing the customer journey and payments across channels such as physical stores, e-commerce, click and collect or drive through.

In a multichannel model, several sales channels coexist, for example a website, stores, an app and marketplaces. Each operates independently, with its own data, experiences and customer journeys. Consumers can purchase both online and in store, but there is little or no continuity between channels.

Cross channel retail marks a first step towards connection. Data starts to flow between channels, which makes services like click and collect or online stock checking for in store products possible. The channels collaborate, but synchronisation remains partial and sometimes inconsistent.

Omnichannel goes further. All channels are connected in real time to deliver a fluid, coherent experience. A customer can start a purchase on mobile, continue on a laptop and complete it in store without any disruption. All touchpoints share the same product information, prices and services. The result is a consistent and seamless experience that strengthens trust and loyalty.

Unified commerce is the most advanced vision of omnichannel. You centralise stock management, payments and customer data across every channel within a single omnichannel sales platform. Customers see real time stock information for both online and in store inventory, benefit from a single basket and enjoy synchronised payments everywhere. In short, multichannel separates, cross channel connects, omnichannel unifies and unified commerce centralises. To succeed with omnichannel sales, you should aim for unified commerce, where payment becomes the common thread running through the entire customer experience.

For a deeper understanding of how payments underpin these models, you can explore Monext’s guides to electronic payments and choosing the right payment service provider.

What does a successful omnichannel sales journey look like?

A successful omnichannel journey rests on a simple promise, giving customers the freedom to start their purchase on one channel, then continue or complete it on another without any friction. Online research often plays a crucial role, even when the final payment happens in store.

GE Capital Retail Bank’s Second Annual Shopper Study shows that 60 percent of consumers start major purchases with a search engine, then move to the retailer’s website, and ultimately 88 percent still complete their purchase in store. This behaviour illustrates how digital touchpoints and physical checkout now work together across the purchase journey.

In practice, this reality translates into several common scenarios that you probably see already. In a typical web to store journey, a customer browses your website, finds a product and checks its availability in their nearest shop before visiting to complete the purchase. They expect to see the same product, at the same price, with the same information they saw online.

Click and collect journeys have become standard. Customers order and pay online, then pick up their purchase in store. This model demands tight coordination between payment, stock management and in store experience. Any gap at the moment of pickup can damage trust.

Try and buy journeys blend physical and digital strengths. Customers test a product in store, then complete their purchase online to benefit from home delivery or a personalised offer. Physical experience adds reassurance, while digital channels provide convenience.

Mobile showrooming is another powerful trend. Many shoppers use their smartphone in store to compare prices, read reviews or check product details. This behaviour shows how important it is to provide consistent information and payment options across mobile, web and in store terminals.

Each of these hybrid journeys has a common factor. Payment must be simple, secure and coherent, regardless of where it happens. This is where omnichannel sales truly come to life, in your ability to unify the payment experience across every channel.

For more ideas on how payment design affects performance, you can explore Monext’s articles on checkout UX, abandoned carts and the impact of payment methods on conversion rates.

The payment challenges behind omnichannel sales

Moving towards unified commerce means tackling three key challenges, technical, organisational and security related.

Unifying payment systems across channels

Many merchants still run separate systems for online and in store payments. This fragmentation creates data silos, with scattered customer information, complex reconciliation and limited visibility over performance. It also makes it harder to deliver a truly fluid experience, because each channel is managed independently.

For large retailers, synchronising payments for e-commerce, drive through and physical stores becomes a major operational and strategic challenge. Unifying payment flows through a single omnichannel sales platform is now a prerequisite. It simplifies reconciliation, clarifies reporting and creates the foundations for a consistent customer experience.

Synchronising data in real time

Few experiences frustrate customers more than placing an order for a product shown as available, only to discover it is actually out of stock. Real-time synchronisation between channels helps avoid this situation. It ensures that stock, prices and promotions are aligned everywhere.

This level of operational agility is particularly critical for retailers managing thousands of SKUs across multiple channels. A unified platform that connects payments, stock and customer data reduces errors and supports more sophisticated omnichannel services like ship from store or flexible delivery options.

Ensuring security on every channel

Whether they pay online, in an app or in store, customers expect the same high level of security. Protecting sensitive data and preventing fraud are non negotiable conditions for trust.

To meet these expectations, you need robust PCI DSS certification for data protection, strong customer authentication under PSD2, tokenisation of card data across channels, and real time fraud detection. Together, these elements secure every step of the payment journey without adding unnecessary friction.

Offering payment methods that support omnichannel sales

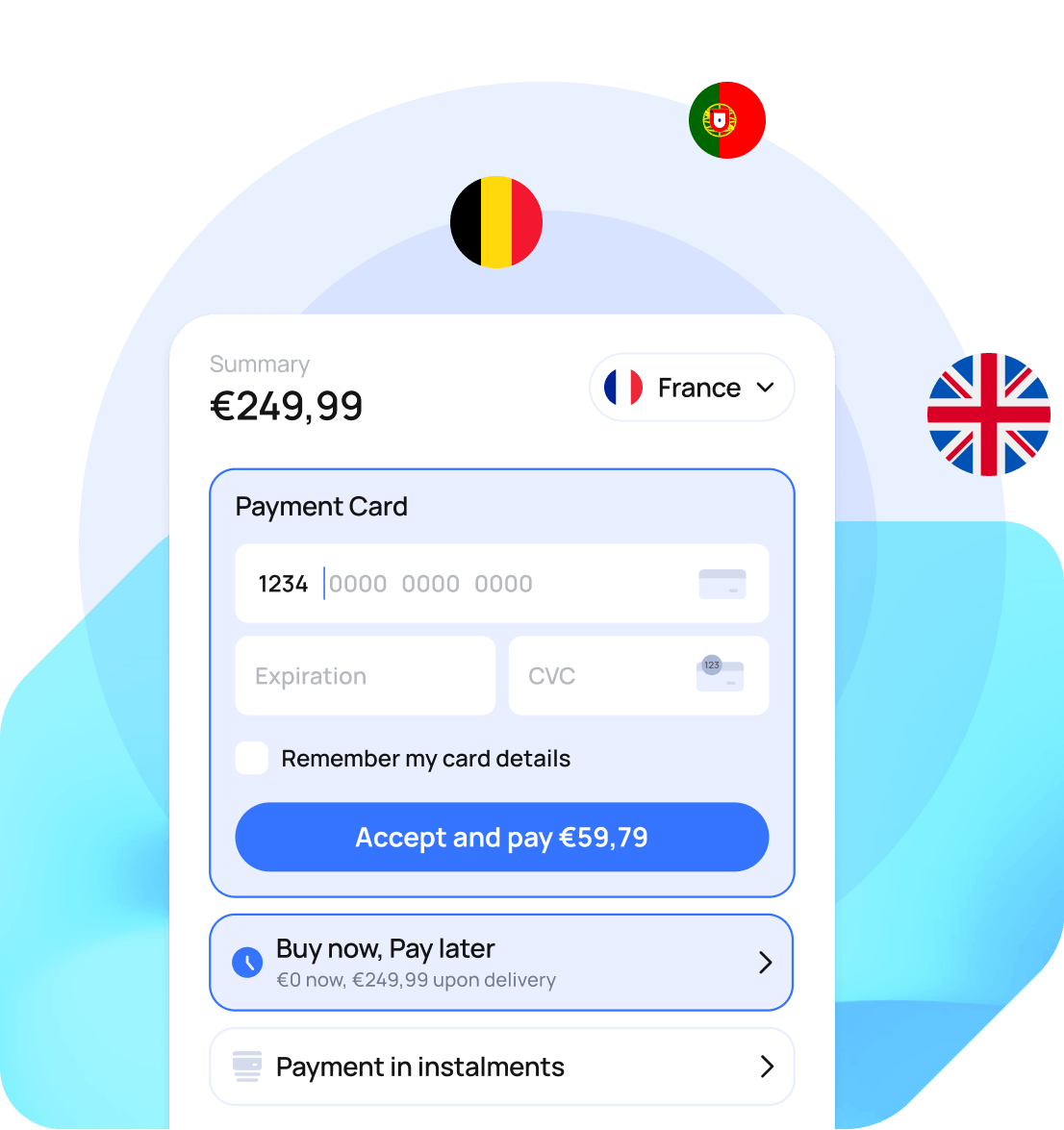

Payment preferences vary depending on channel and context. Online, customers may favour Apple Pay, Google Pay or Click to Pay for speed and convenience. In store, many still prefer contactless cards or mobile wallets. For higher value purchases, for example above £100, shoppers may look for Buy Now Pay Later (BNPL) options or instalment plans.

Your payment solution must adapt to this diversity without complicating internal operations. That means proposing the right mix of cards, digital wallets, BNPL solutions and local methods, all managed through a single platform.

Click to Pay can shorten online checkout and reduce friction, while Pay by Link simplifies remote payments for customer service teams, sales agents or phone orders. BNPL solutions like Klarna or PayPal Pay in 4 make larger baskets more accessible and help you boost average order value.

To understand how local preferences influence performance, or how to optimise your payment page across devices, you can refer to Monext’s content on payment page optimisation and local methods.

Monext: an omnichannel sales platform built for unified commerce

In response to these challenges, Monext offers an integrated approach tailored to merchants investing in omnichannel strategies. The solution is designed as an omnichannel sales platform that unifies all your sales channels and payment flows.

Monext’s payment solution covers online, mobile and in store payments within a single environment. Your customers enjoy the same quality of service and payment options whether they buy on your website, in your app, in store or via click and collect. At the same time, your teams benefit from simplified operations and centralised management.

Flexible features that grow with your business

Monext’s platform is built to evolve alongside your business. You can add new sales channels, activate new features and expand internationally without changing provider. The solution supports modern omnichannel journeys such as optimised click and collect, fluid web to store experiences and simplified try and buy flows where customers can test in store and purchase online, or the other way round.

Innovative payment options, including BNPL through partners like Klarna or PayPal Pay in 4, Pay by Link and split payments across multiple cards, help you address varied customer expectations. Card updater features automatically refresh cards that are about to expire, ensuring the continuity of recurring payments and subscriptions.

You can also trigger payment at the most appropriate moment in the journey, for example at order placement, shipment or delivery, depending on your business model. This flexibility makes it easier to support complex omnichannel scenarios.

Extensive coverage of payment methods

Monext supports more than 80 payment methods to cover all your channels and customer segments. The portfolio includes international card schemes such as Visa, Mastercard and American Express, digital wallets like PayPal, Apple Pay, Google Pay, Samsung Pay and Amazon Pay, BNPL solutions including Klarna and other providers, as well as local methods like Bancontact, iDEAL, Bizum, Satispay, Alipay and WeChat Pay, alongside meal vouchers and gift cards.

This breadth allows you to adapt your offer to each market and audience while managing everything from one interface. Smart Display features can help you show only the most relevant payment methods according to context, for example country, basket amount or delivery method, which makes checkout clearer and more efficient.

Centralised data to steer your omnichannel sales

By unifying payment flows, Monext centralises all your data in a single dashboard. This consolidated view gives you actionable insights to refine your strategy. You gain a clearer understanding of customer behaviour, compare channel performance and detect new growth opportunities.

You can identify the most effective journeys, pinpoint friction points and activate personalisation levers. This enriched view of your customers turns payment data into a strategic asset for optimising your omnichannel sales.

Trusted by leading retailers

Monext supports major players in retail and large scale distribution in their omnichannel strategies. These clients rely on Monext’s platform to deliver harmonised purchase journeys across physical stores, websites and mobile apps. Their trust shows Monext’s ability to manage complex environments, high transaction volumes and strict performance requirements, while continuously optimising the user experience at every touchpoint.

How to make your transition to omnichannel sales a success

If you want to develop or optimise your omnichannel strategy, you can progress step by step with a clear roadmap.

Start by auditing your current customer journeys. Map the touchpoints between your customers and your brand, analyse the most frequent paths, identify friction points and uncover unmet expectations. This audit will help you prioritise investments and quick wins.

Next, unify your payment systems. This is often the most transformative project. Replace siloed tools with a unified payment platform that centralises your payment flows, data and reporting. This unification simplifies day to day management and unlocks new possibilities for unified commerce.

Then, train your teams. Omnichannel is not just a technological shift, it is also a cultural one. Store teams need to feel comfortable with digital tools, understand new customer journeys and support shoppers as they move between channels.

Adopt a test and learn mindset. Omnichannel is a continuous improvement journey. Experiment with new services such as click and collect, Pay by Link or mobile payments, measure the impact, gather customer feedback and adjust your approach.

Finally, choose a trusted partner. Your payment provider plays a central role in your omnichannel success. Select a partner that understands your business challenges, offers a unified solution for all channels, provides personalised support and actively invests in innovation. Monext’s resources on selecting a PSP can guide you through this decision.

Turn omnichannel sales into a growth driver

Omnichannel sales are no longer reserved for large groups. They are becoming essential for any merchant who wants to meet modern customer expectations. By unifying your sales channels, centralising payment flows and offering a fluid experience at every step, you create a sustainable competitive advantage.

Monext supports this transformation with a solution designed for unified commerce, a unified payment platform, a wide range of payment methods, innovative features and expert support. Whether you run physical shops, an e commerce website or both, Monext helps you build a secure, high performing omnichannel customer journey.

If you are ready to transform your customer experience and boost your growth, you can speak to Monext’s payment experts and request a personalised demonstration to assess the concrete benefits for your business.