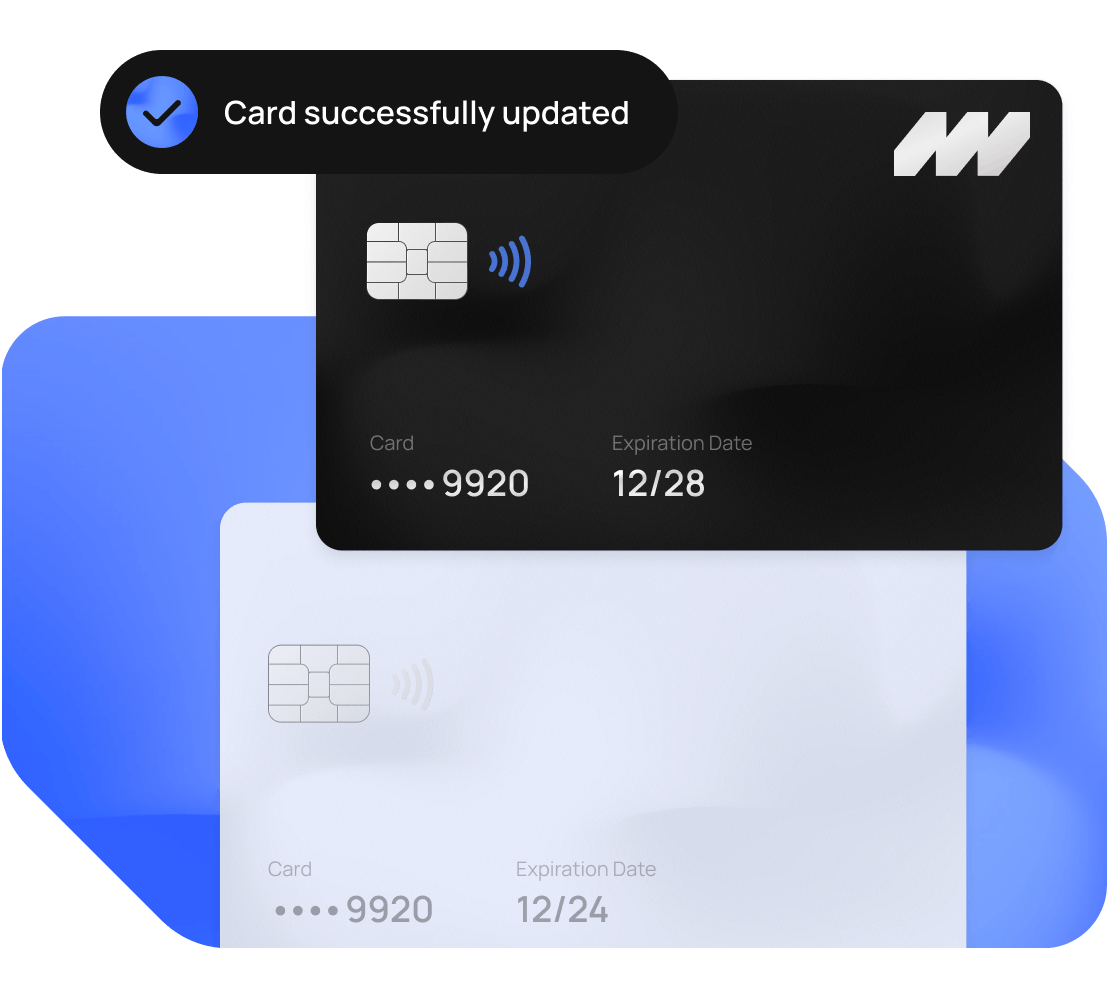

CARD DATA UPDATES

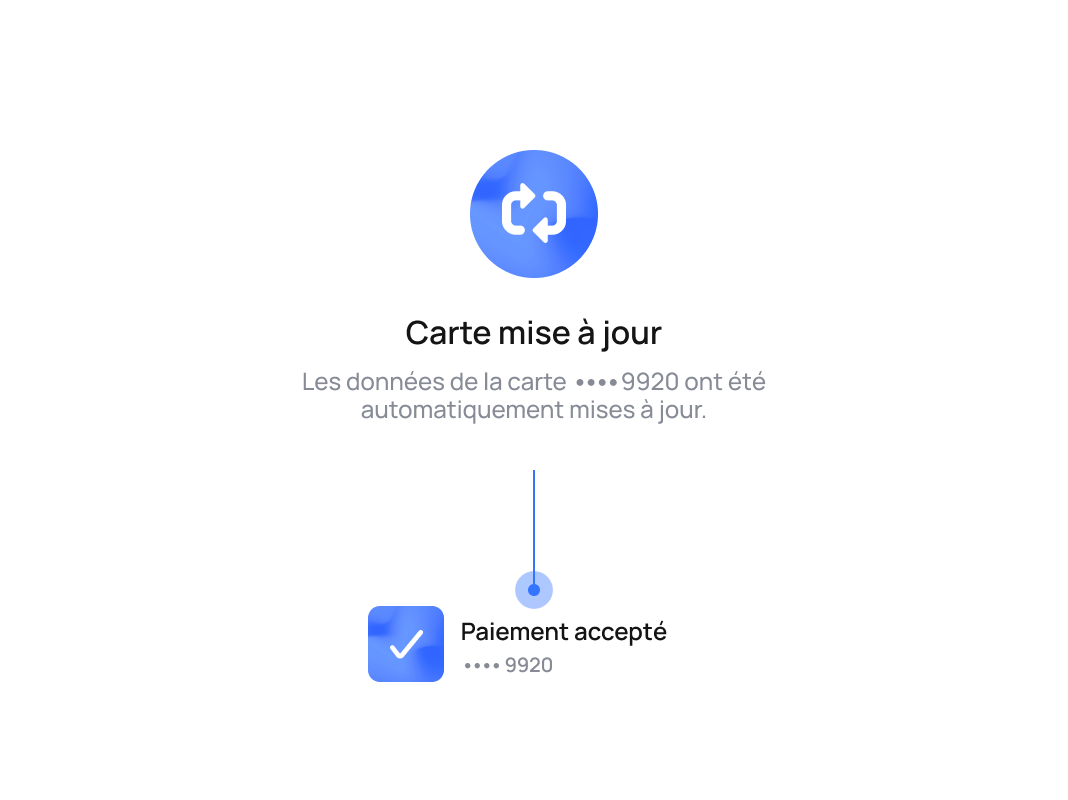

With card data updates, streamline your payments and ensure uninterrupted service delivery.

ALWAYS IN FLOW, NEVER SLOW

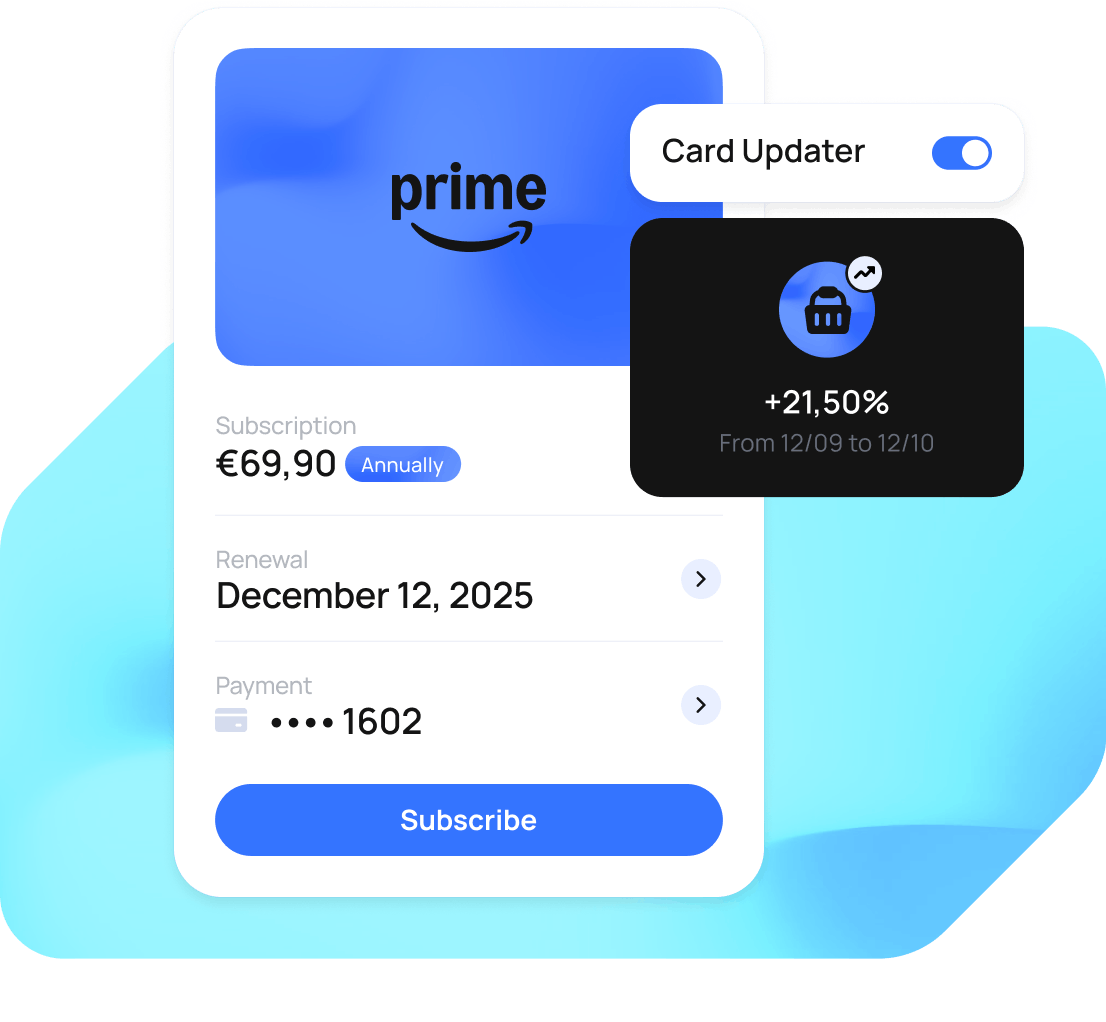

Thanks to the card updater, your customers' stored card information is automatically refreshed.

ALWAYS IN FLOW, NEVER SLOW

Steady Finances, No Surprises

With Monext, offer this feature to your customers quickly and effortlessly.

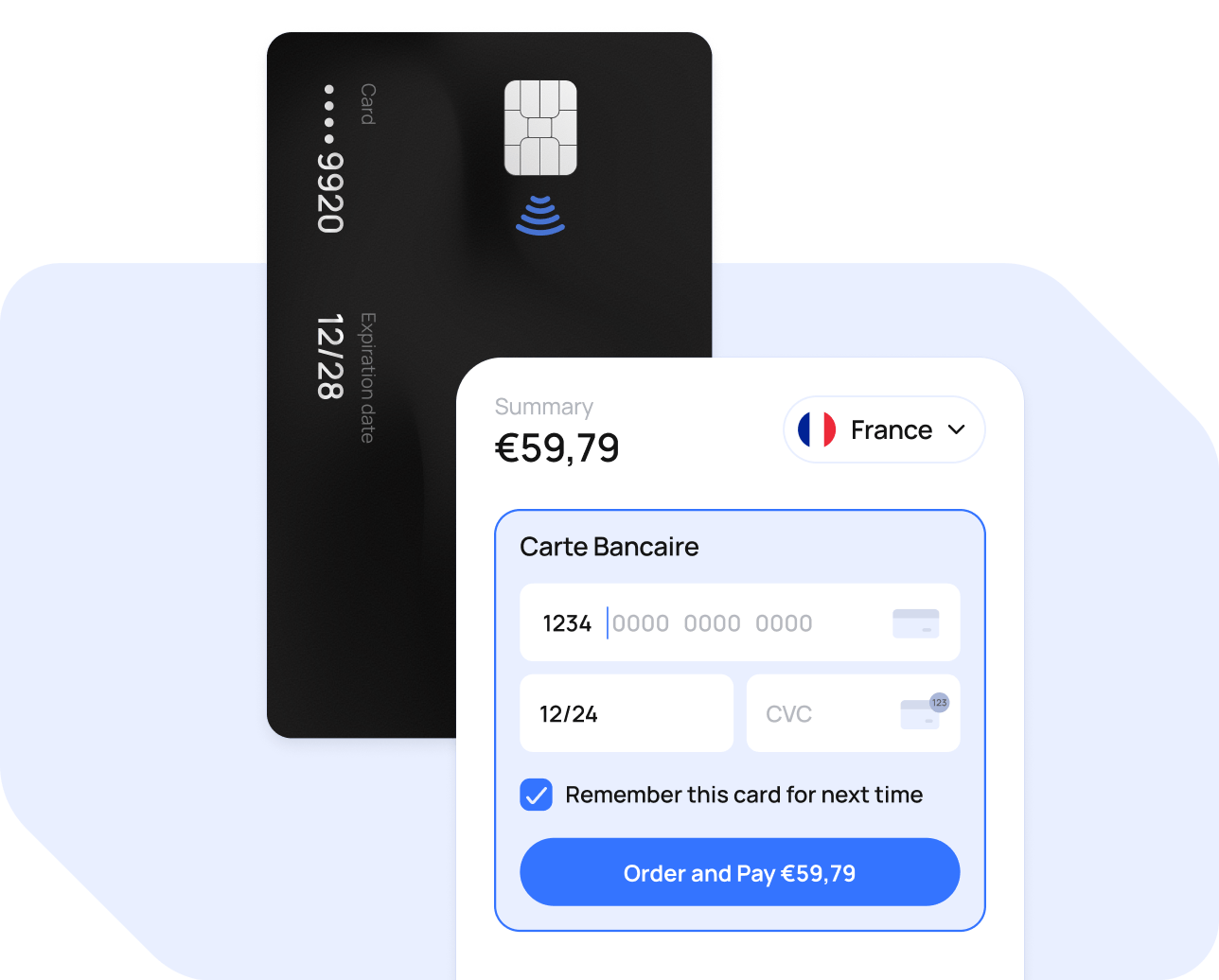

NETWORK SELECTION

Monext intuitively identifies the banking network and initiates the update.

DATA RECEIPT

Receive real-time responses with updated card information (card number, expiration date).

ADVANTAGES FOR BUYERS

- Intuitive, simple, and fast payments.

- No action required thanks to automatic updates.

ADVANTAGES FOR MERCHANTS

- Boosted conversion rate.

- Fewer cart abandonments and lost customers.

- Simple and quick onboarding.

- A seamless and transparent implementation.

VALUABLE COLLABORATIONS

FREQUENTLY ASKED QUESTIONS ABOUT CARD UPDATING

How do card updating tools work?

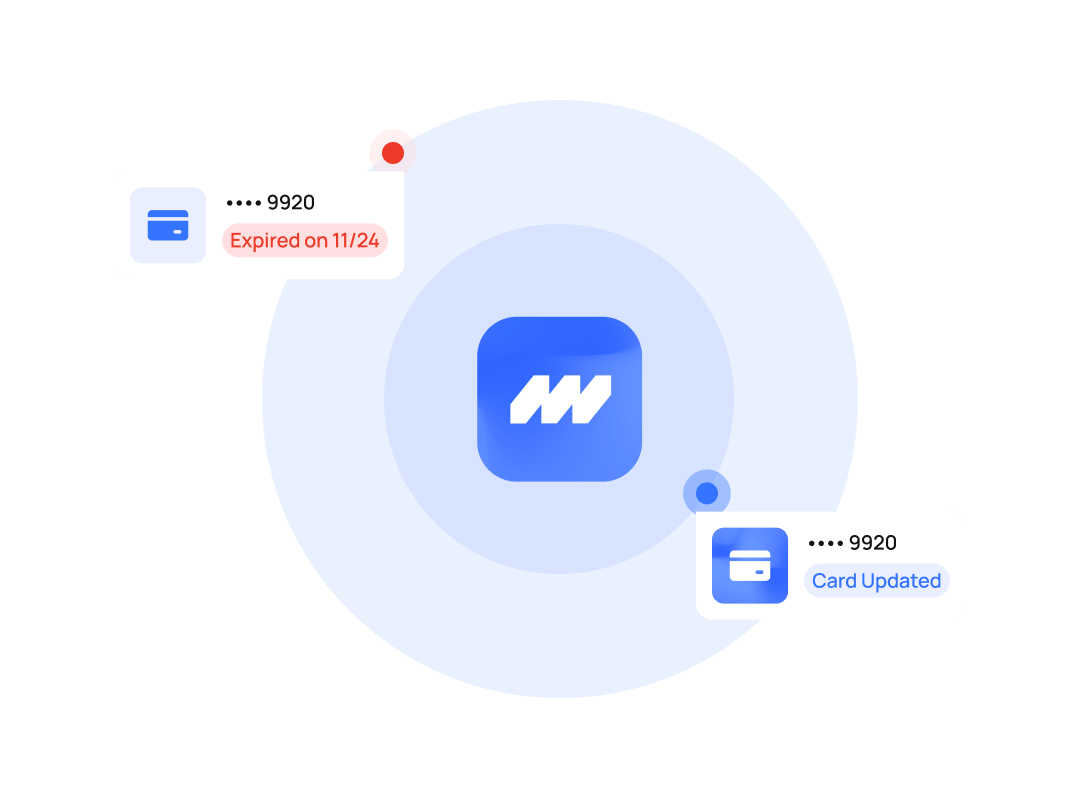

Card updating tools are used to keep payment information updated in payment systems, thereby preventing failed payments due to cards expiring or any other event occurring on users’ payment cards.

These services are based on a programming interface (API) that automates the updating of card data in real time. When a card is updated, the network sends the new card details to service providers to ensure uninterrupted service. This functionality is particularly useful for recurring payments, frequent payments or in the event of cards recorded for one-click payments, thus ensuring a better user experience and reduced payment processing interruptions.

How do I select and implement a card updating tool?

The implementation of an updating tool must follow a structured approach:

- Needs assessment: Identify sensitive payments, recurring payments and the most common cases of card expiry.

- Selecting the right service provider: Compare available solutions according to service conditions, transaction fees and the tools’ service quality.

- Configuration and integration: Install the programming kit, configure the programming interface and test the real-time updating of users’ cards.

- Optimisation and monitoring: Analyse technical errors, monitor automated updates and adjust the configuration if necessary.

Through these services, companies ensure optimised payment information management, and prevent interruptions due to expired cards, thereby guaranteeing a better payment experience for their users.

Why is automated card updating essential for merchants?

Automated card updating is a major asset for merchants offering recurring or frequent payments. By keeping payment cards up-to-date, they reduce the number of failed payments related to expired cards and ensure service continuity.

An effective card updating service is a means of optimising financial management, avoiding payment processing interruptions and improving user loyalty. Companies who do not implement this solution risk losing sales and incurring additional costs related to unplanned retries and transaction fees.

The card updating service is particularly useful for which types of businesses?

A card updating tool is essential for all companies depending on recurring payments or regular transactions made by card.

The business sectors concerned include:

- SaaS subscriptions and streaming platforms, which must prevent interruptions to subscriptions, particularly due to expired cards.

-E-merchants and marketplaces, which offer customers the option of saving their card data for one-click payments.

- Ticketing and booking services, for which payment information updates are vital to guarantee booking availability.

Thanks to automated updates, these companies can minimise failed payments and optimise their growth by limiting the number of customers they risk losing.

How are card updating tools integrated?

Integration of a card updating tool requires a programming interface (API) which connects to existing payment systems. Several stages are necessary:

- Connection to card networks: The tool interacts with payment card networks (Carte Bancaire, Visa, Mastercard, etc.) to recover updates in real time.

- Identification of cards to be updated: It detects expired cards, cards which have changed number or updates by service providers.

- Automated updates of customer accounts: It applies the automated updates directly in users’ payment details.

- Security and compliance: All card details are processed in compliance with card industry standards to ensure transaction security.

What are the risks of not automating card updates and how can they be mitigated?

A failed card update can result in major repercussions for merchants, including:

❌ Interrupted recurring payments, impacting service continuity.

❌ A loss of turnover due to rejected payments.

❌ An increase in transaction fees related to retries.

❌ User frustration, which could force them to give up on the service for good.

To mitigate these risks, an effective card updating service that guarantees automated updates and proactive monitoring of up-to-date cards is vital. An effective integration with service providers is also a means of anticipating expired cards and ensuring seamless payments.

NO CONTACTLESS WITH MONEXT

Our teams are always here to listen and assist with any questions, collaborations, or commercial inquiries.