The Belgian Payment Landscape: A Rapid Shift to Digital Habits

Belgium is undergoing a significant transformation in the way people pay. According to the 2025 Digital Payments Barometer by Ipsos and the Vrije Universiteit Brussel, 84 percent of Belgians now prefer electronic payments over cash. This shift creates real opportunities for merchants who adapt their offer to these new expectations.

Contactless payments have become the standard. Sixty percent of Belgians use contactless every week with their bank card. Mobile payments are also gaining ground. Mastercard data shows that more than one in two Belgians used a mobile payment in 2025, whether through a QR code or a smartphone tap. QR code usage alone grew from 42 to 48 percent of the population.

This accelerated transition makes payment choice a powerful growth lever. Offering the right Belgium payment methods enhances both conversion and customer satisfaction, online and in store.

Bancontact: The Cornerstone of the Belgian Payment Ecosystem

Discussing Belgium payment methods inevitably leads to Bancontact, the domestic scheme that structures the local landscape. Highly familiar and widely used, Bancontact is essential for any merchant targeting Belgian consumers. Its presence reassures customers and reduces friction throughout the checkout experience.

Payconiq by Bancontact further enriches this ecosystem with a simple mobile solution based on QR codes and contactless payments. Its ease of use aligns perfectly with Belgian expectations for speed and convenience. In 2026, the Bancontact ecosystem will integrate Wero, a new pan European solution, while maintaining current functionalities.

For an online business, integrating Bancontact and Wero is a strategic priority. A smooth Bancontact payment experience signals reliability, increases trust, and directly improves conversion rates.

International Cards and Digital Wallets: Expanding Payment Possibilities

While domestic solutions dominate, international cards remain essential. Visa, Mastercard and American Express cover a large share of Belgian transactions, especially for higher value purchases or international buyers.

Digital wallets are also rising steadily. Apple Pay, Google Pay and Samsung Pay benefit from strong contactless adoption and offer a secure and fluid experience. For Belgian shoppers who rely heavily on mobile payments, these wallets simplify checkout and reinforce trust.

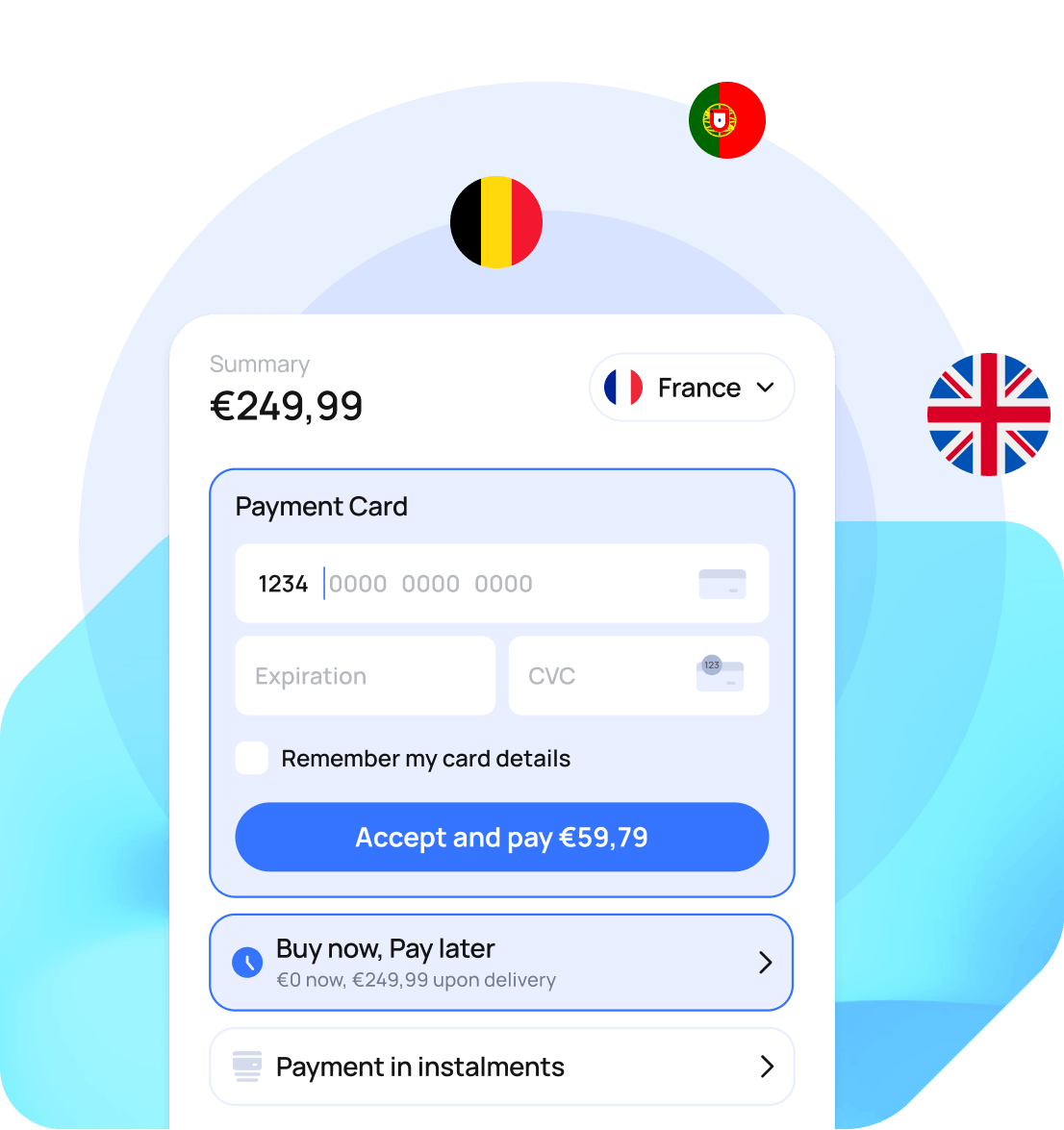

Providing a balanced mix of payment methods is key. The challenge lies in offering enough choice to satisfy diverse preferences while keeping the payment page clear and efficient. Tools like Monext’s Smart Display can help by showing only the most relevant payment options depending on the buyer’s context, reducing hesitation and improving conversion.

Buy Now Pay Later: Meeting Expectations for Greater Flexibility

Buy Now Pay Later (BNPL) continues to grow across Europe, and Belgium follows the trend. This payment method allows shoppers to spread their spending without additional fees, which boosts average basket value and reassures buyers who hesitate at checkout.

Several players stand out. Klarna offers a strong European presence. Floa, part of BNP Paribas, provides flexible financing. PayPal Pay in 4 combines PayPal’s brand trust with instalment convenience.

BNPL supports commercial performance in a tangible way. It reduces psychological barriers to purchase, especially when spending reaches £100 or more. For that reason, instalment solutions deserve a central place in your Belgium payment methods strategy.

Choosing the Right Payment Service Provider: The Essential Criteria

Selecting the right payment service provider is a decisive factor in your Belgian strategy.

A strong understanding of the Bancontact ecosystem is essential. Your Payment Service Provider (PSP) should support both Bancontact and Wero while following local developments. Monext recently integrated Keytrade Bank cards into the Bancontact network, enabling this digital bank to offer all domestic payment features to its customers. This type of partnership shows how important it is to work with a provider that truly understands local dynamics.

Your PSP must also cover a wide range of local and international solutions, from Bancontact payment features to cards, wallets, BNPL options such as Klarna or Floa.

Security and compliance are equally important. Belgian consumers are particularly sensitive to data protection. Ensuring continuous monitoring and strong PCI DSS compliance builds trust and prevents incidents.

Local expertise also makes a difference. Monext provides dedicated experts who understand Belgian expectations and support you during integration, optimisation, or the addition of new payment methods. A personalised approach accelerates deployment and boosts performance.

Finally, your PSP must offer flexible technology. Plug ins for WooCommerce, Shopify, PrestaShop or Magento make integration easier. Modular features and compatible payment gateways support your growth and help you adapt to new use cases.

Succeeding in the Belgian Market: Key Takeaways

Belgium’s payment habits reflect a strong preference for digital solutions and trusted local methods like Bancontact. To succeed, you need a strategy built on three pillars.

First, offer the payment methods Belgian consumers expect. Bancontact and Wero form the foundation, supported by international cards, digital wallets, and BNPL to cover all buyer profiles

Second, focus on user experience. A simplified path to payment, personalised display of available options and high security standards reduce friction and improve conversion. For deeper insights, explore how different payment methods affect conversion rates or how to optimise your checkout flow.

Third, rely on a flexible and responsive partner. A PSP that understands Belgian specificities, supports a wide range of solutions and provides strong technical expertise helps you focus on growth while maintaining a smooth and secure payment environment.

Belgium’s payment ecosystem will continue to evolve. Mobile QR payments and new instalment solutions are gaining momentum. Your ability to adapt quickly will set you apart from competitors and strengthen your long term performance.

If you want to optimise your payment strategy for the Belgian market, Monext can support you with Bancontact and Wero integration, international methods, local expertise and dedicated technical teams. You can contact our payment experts to discuss your needs.