It is against this backdrop that the automatic updating of bank card data is a game-changing functionality.

Merchants using recurring payments in connection with a bank card were until now exposed to a churn rate caused by the end of the card’s use (cancelled, lost or expired cards, etc.). This required the customer to update the card on each platform and website on which the card had been recorded not to have to worry about payments. This is a paradox.

Networks such as CB, Visa and Mastercard have pinpointed this issue and have solved it through card data updating services that make life easier for customers and optimise performance for e-merchants.

Find out more about how this technology works and why it is becoming a key part of the e-commerce ecosystem.

How does automatic card data updating work?

When a bank card expires or has been lost or replaced, the details must be updated for the merchants which have a record of the card. This is tedious for customers and problematic for merchants, who run the risk of having payments interrupted and subscriptions cancelled.

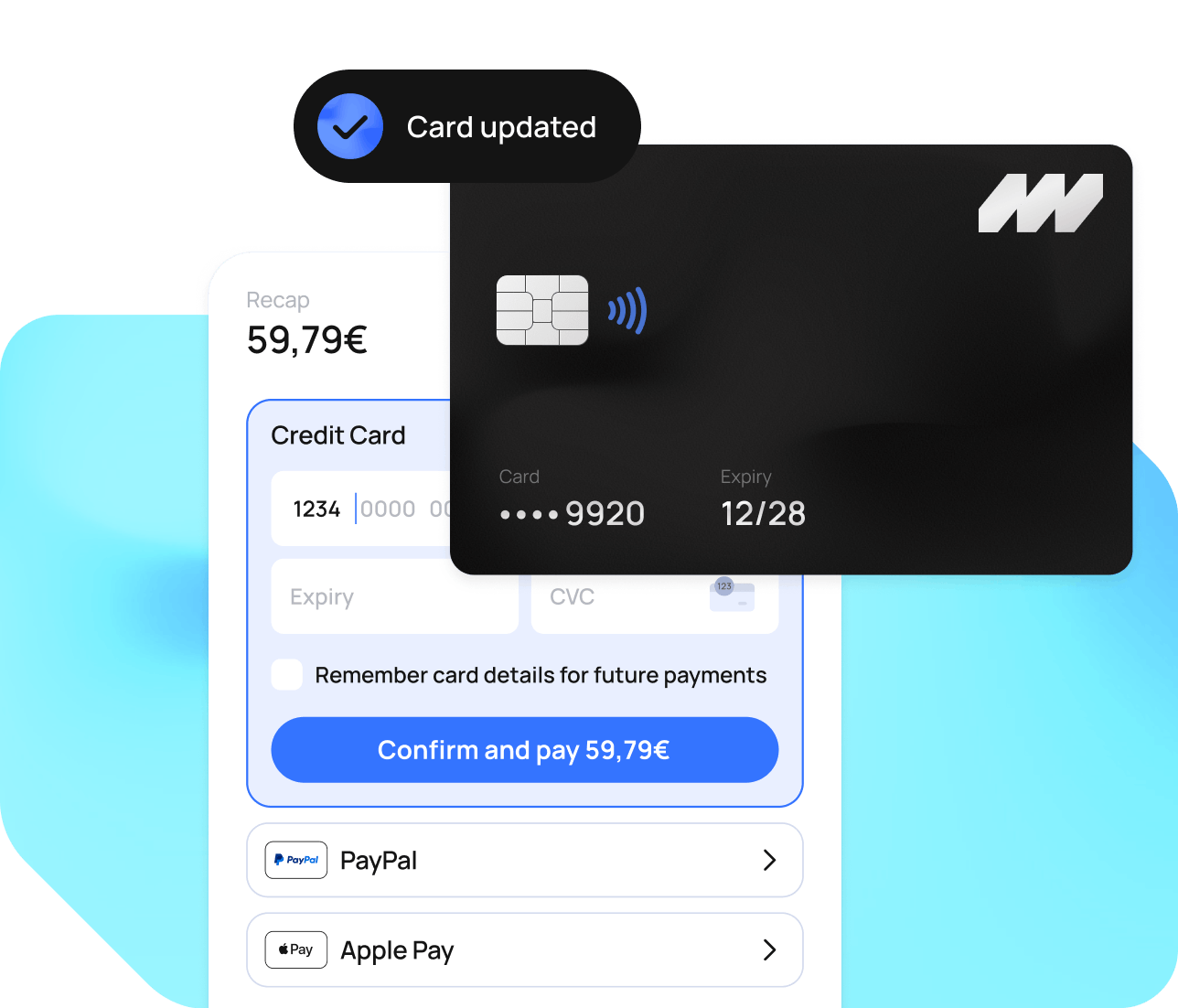

This is where the automatic card data updating service comes in:

1. Via its payment service provider, the merchant consults the “card updater” services on the networks.

2. The network provides new available data in real time, such as the card number and new expiry date.

3. Data is updated securely and transparently, without the customer having to do anything.

What are the benefits for customers?

For customers, this service is a real revolution:

Simplicity and peace of mind

It is no longer necessary to update card details on every site to avoid interrupted services. Whether for subscriptions to a streaming platform, a cloud service or for split payments, it is all done automatically.

No interruptions to services

With card data being constantly up-to-date, subscriptions and recurring payments continue without a hitch, which prevents the inconvenience of rejected payments.

Heightened security

Updates use highly secure bank network channels, which guarantee data confidentiality and integrity.

The benefits for merchants

For companies, this service is a genuine lever for growth and optimisation:

An improved conversion rate

With card data that is always up-to-date, the risk of rejected transactions is considerably reduced. This results in fewer abandoned baskets and more conversions.

Customer loyalty

By preventing service interruptions, you guarantee a better user experience, which builds long-term customer loyalty.

Technical simplicity

This process is entirely transparent for the merchant who enjoys quick and easy onboarding through the solutions offered by MONEXT.

Financial losses reduced

With payments that continue to flow, you minimise the losses related to failed transactions or subscriptions that are inadvertently cancelled.

The practical example of CGR

CGR Cinémas, which is one of the largest networks in France, adopted this solution to offer service continuity to its regular customers and subscribers.

Examples of uses by CGR

- Monthly subscriptions: Cinema-lovers can use their unlimited cards without interruption, even when their bank cards are renewed or lost.

- Quick payments (one-click): When booking on-line, the experience remains seamless and instant thanks to data that is always up-to-date.

Concrete results

Since Updat’R by CB was integrated via MONEXT, CGR Cinémas has observed significant improvements:

- More than 1,000 cards updated automatically, preventing as many situations in which payments could have been rejected.

- Improved service continuity, heightening customer satisfaction and loyalty.

- A significant reduction in basket abandonment.

- €16,000 in turnover recovered, simply thanks to the automatic updating of card data.