Payment with Multiple Cards

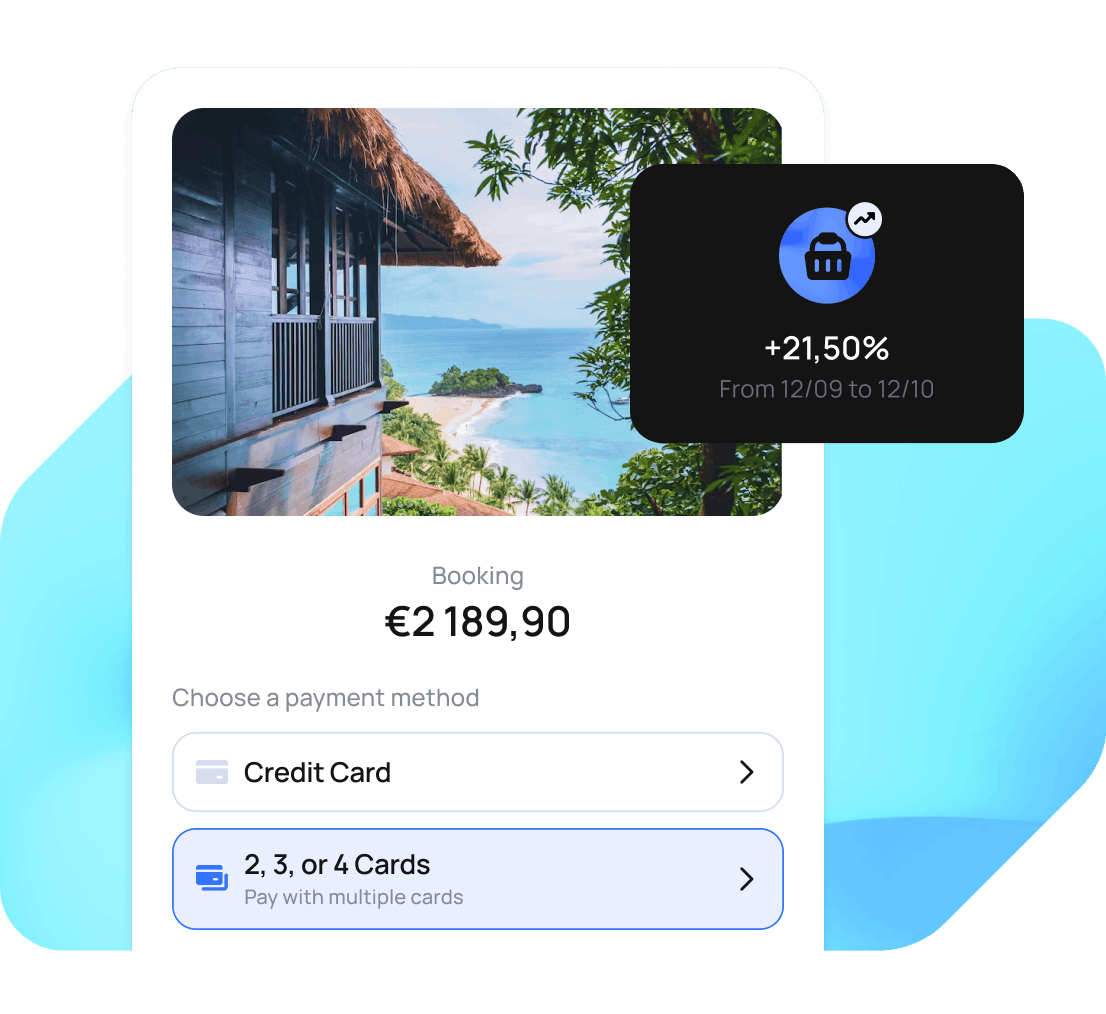

Allow your buyers to share a purchase and split the total amount of a cart smoothly and easily across multiple cards.

À la Carte Experience

Payment with Multiple Cards allows buyers to share a purchase and split the total amount of a cart smoothly and easily across several cards.

À la Carte Experience

APPROVED BY BUYERS

- They divide their spending as they wish.

- They avoid potential payment limits.

- They benefit from optimal coverage by combining the insurance of all their cards.

AND BY MERCHANTS

- Fewer abandoned carts and lost customers.

- Positive impact on average order value.

- Easy to set up and compatible with payments on shipping or at checkout, cancellations, and partial or full refunds.

VALUABLE COLLABORATIONS

FREQUENTLY ASKED QUESTIONS ABOUT MULTI-CARD PAYMENTS

Why pay on-line with several payment cards?

On-line payments with several bank cards meet the needs of customers and merchants. Here are the main reasons why this option is appropriate:

- Purchases can be shared easily

- Payment card ceilings are maximised

- The advantages of bank cards are optimised

- Several sources of financing can be managed

- The on-line payment experience is facilitated

- Payment accessibility is enhanced

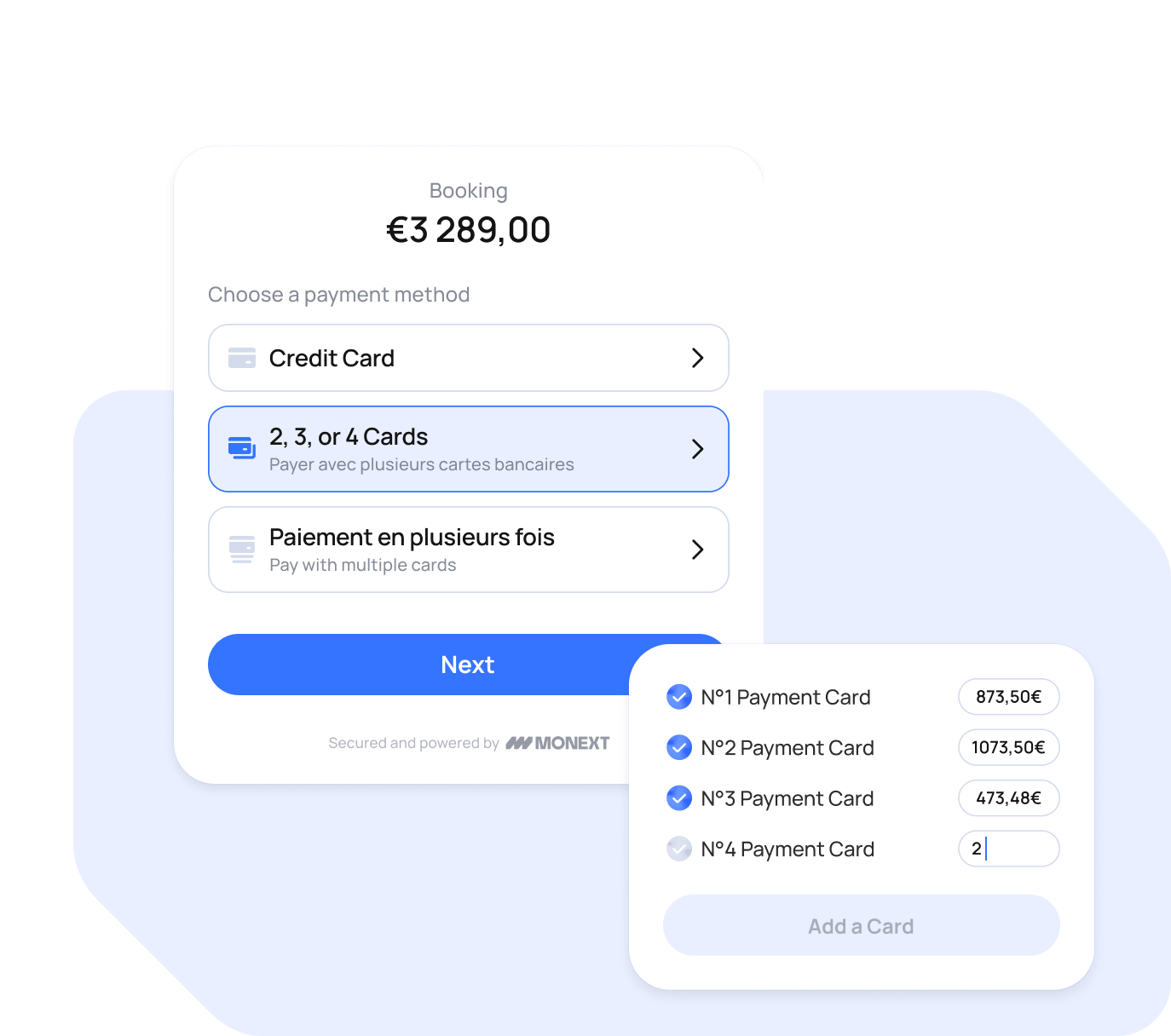

How do multi-card payments work?

When a basket is confirmed, MONEXT’s on-line payment solution can be used to:

- Split the total payable amount between several payment cards

- Enter data for each bank card used

- Automatically update the balance payable by other cards

- Finalise the transaction, with each payment card being debited the allocated amount.

The steps to payment:

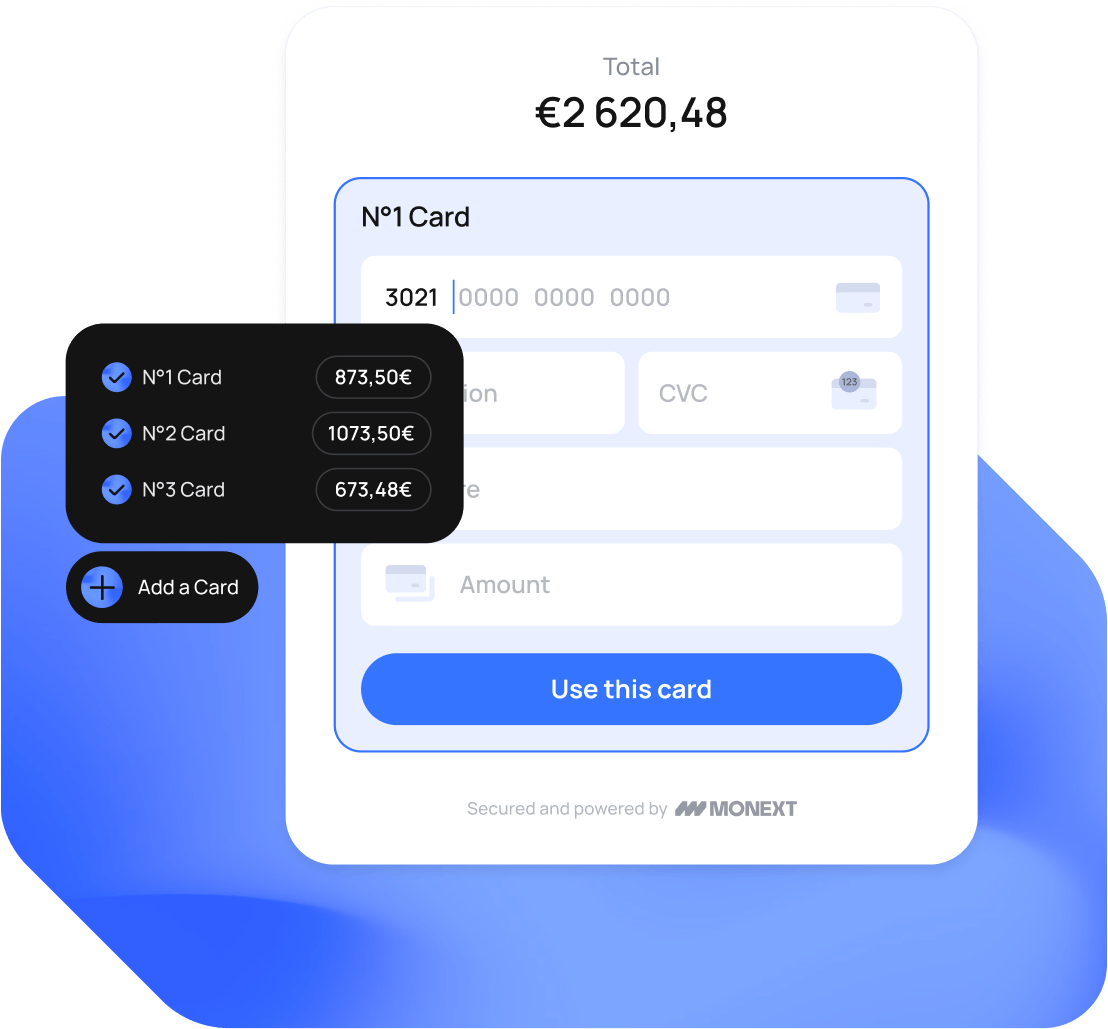

Step 1: The customer selects “bank card” (CB, Visa or Mastercard) as the payment method, enters their card details and defines the amount to be debited from the first bank card.

Step 2: This payment is then displayed together with the outstanding amount of the order. The customer enters the additional payment details and the amount to be debited and then finalises the payment.

Step 3: MONEXT displays the payment receipt, summarising all payments and the payment breakdown.

This functionality relies on advanced payment solutions integrated by specialist providers such as MONEXT, ensuring security and a seamless experience throughout the process.

How can group payments be offered to customers?

To enable your customers to pay with multiple payment cards, you simply need to activate the “multi-card payment” functionality in your merchant back office.

For all your baskets with high amounts such as plane tickets or expensive products, it is appropriate to propose the multi-card payment functionality. It can be used to immediately distribute the amount across several payment cards, as is possible in-store on a payment terminal.

In the specific case of purchases of plane or travel tickets, this option has the added advantage of cumulative insurance cover from each bank card used.

Is there a limit on the purchase amount per card?

Card payments are limited by a ceiling set by the customer’s bank. For purchases representing large amounts, the bank card ceiling may result in a rejection.

Multi-card payment may be a good way of overcoming this issue by splitting the purchase over several cards: for a purchase shared by several people or to use a personal payment card and a joint payment card for example.

Is there a limit on the number of cards that can be used?

The merchant is free to set the maximum number of bank cards that can be used for a payment.

This configuration is completed independently by the merchant on the back office.

NO CONTACLESS WITH MONEXT

Our teams are always here to listen and assist with any questions, collaborations, or commercial inquiries.